By Charles R. Kennedy, CPA, MBA

Vice President

Director of Tax Services

After passage of the One Big Beautiful Bill Act (OBBBA), the US Department of the Treasury and Internal Revenue Service are clarifying definitions and provisions for the tax-related portions of this new law. As you plan for 2025 tax filing, we have provided an overview of these individual tax provisions and what they could mean for you. This includes tax strategies for businesses with pass-through income.

| Tax Provision | What it Means | Who is Eligible |

|---|---|---|

| Standard Deduction & Tax Brackets | There is a permanent extension of the standard deduction and seven tax-rate brackets | Single/Married Filing Separately - $15,750 Head of Household - $23,625 Married Filing Jointly - $31,500 |

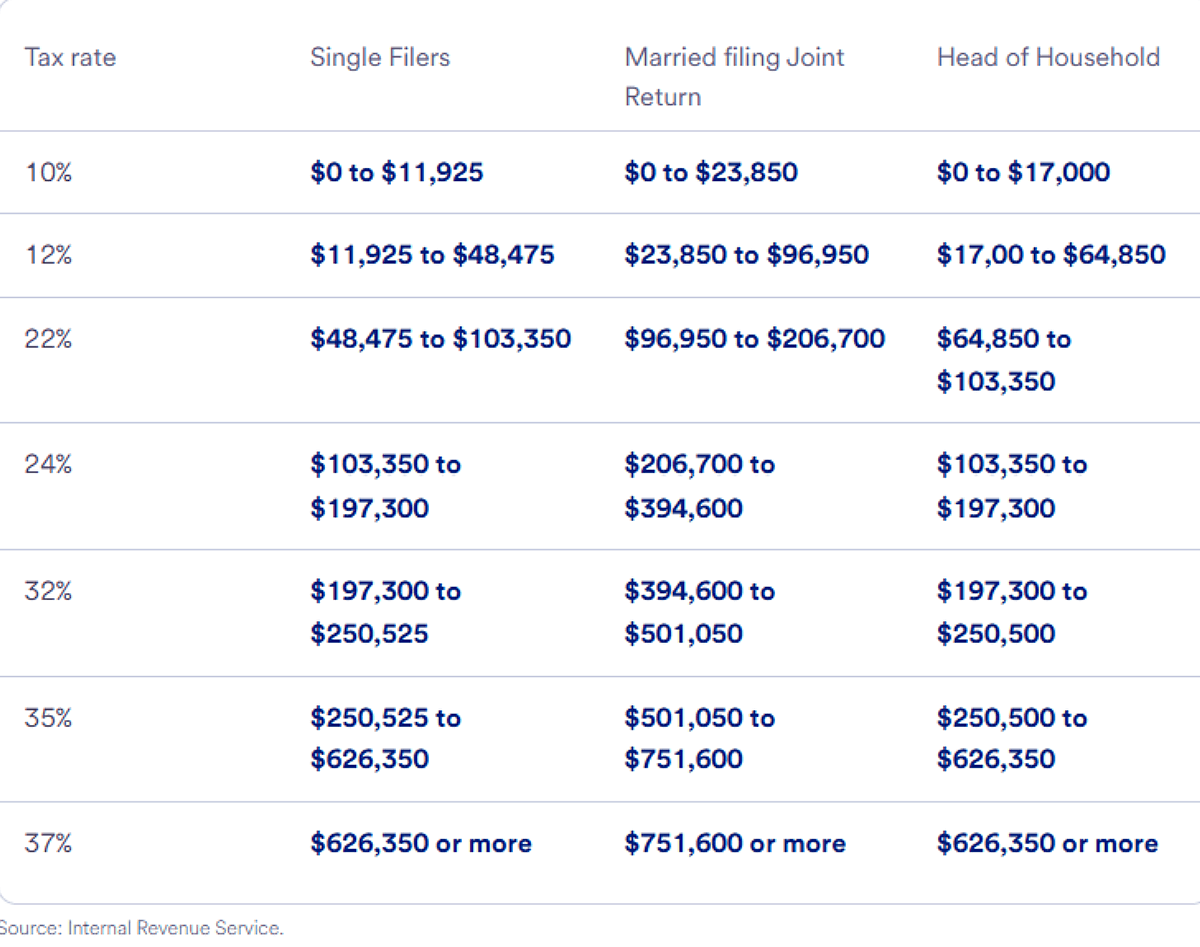

The federal tax brackets made permanent are as follows, with an initial inflation adjustment in 2026 for the first two brackets: 10%, 12%, 22%, 24%, 32%, 35%, 37%.

In addition to the updated standard deduction listed in the box above, there is also a “senior bonus” deduction available for tax years 2025-2028 of $6,000 (ages 65+ single) or $12,000 if both spouses are 65+ at the end of 2025. There are phaseout limitations for single filers after $75,000 of median adjusted gross income (MAGI) and over $150,000 of MAGI for joint filers.

This senior bonus deduction is over and above the standard deduction that has been in place for decades for taxpayers age 65 and older or taxpayers who are blind ($1,950 for single or head of household or blind; $1,550 per qualifying spouse for married joint filers if either is 65+ or blind; both are inflation adjusted annually).

The general personal exemption deduction remains eliminated (as it was under the Tax Cuts and Jobs Act of 2017).

Note: You can’t claim most itemized deductions if you claim the standard deduction. Under the OBBBA, most miscellaneous deductions have been eliminated. However, the Educator Expense Deduction remains and was raised to $300 per eligible educator.

| Tax Provision | What it Means | Who is Eligible |

|---|---|---|

| Child Tax Credit (CTC) | The child tax credit has increased from a maximum of $2,000 o $2,200 per qualifying child beginning in 2025 | Taxpayers with children/related minors who reside with them for over half the year who are under age 17 at the end of the tax year. |

| Tax Provision | What it Means | Who is Eligible |

|---|---|---|

| Tips Deduction | Deduction of all qualifying tips up to $25,000 in a taxable year, for tax years 2025 - 2028 | Workers in eight eligible, service-based industries in which tips are customarily given |

| Overtime Deduction | Deduction up to $12,500 for qualified overtime compensation, the “half” of time and a half over the regular rate, for tax years 2025-2028 | Workers in eligible industries who receive “time and a half” overtime pay as part of their wage contract. |

| New Vehicle Loan Interest Deduction | Deduction up to $10,000 in a tax year for interest on loans used to purchase a qualified vehicle, for tax years 2025-2028 | Taxpayers who purchased (not leased) a new vehicle for personal use that was assembled in the US. |

There are income phaseouts for deductions on tips and overtime: $150,000 MAGI for single filers and $300,000 MAGI for joint filers. Overtime is based on required FSLA hours, not voluntary extra work time. For tips eligibility, employer-based service charges do not qualify as deductible tips, even if proceeds are shared among the employees. Tips must be voluntary in nature and cash based (cash, check, debit card, electronic payment). Note: the IRS is still clarifying eligible industries and qualifying tips in a comment period through October 2025.

To qualify for the interest deduction on car loans, the loan must have been originated after December 31, 2024, and relate to a new car purchase of a car, minivan, van, SUV, pick-up truck or motorcycle. The taxpayer must provide the VIN on their return to claim the deduction.

| Tax Provision | What it Means | Who is Eligible |

|---|---|---|

| Estate, Gift and Generation-Skipping Transfer Taxes | Exemption amounts for these tax provisions are increased and made permanent | $15 million exemption per individual, $30 million per married couple |

Plan now for permanent and adjusted federal tax provisions.

• Keep good records of required overtime and tips and make sure that qualified employers are providing statements/forms as required.

• Include a valid VIN for eligible new car loan interest deductions for personal use vehicles.

• If your income is near any phaseouts for eligible tax deductions or credits, income planning is important to defer income or time deductions properly.

• If you itemize and/or qualify to deduct larger charitable donations, understand the new rules for 2026. You may want to “bunch” or accelerate deductions now or consider alternative charitable giving vehicles. There are tools such as a Qualified Retirement Distribution (QRD) that can be built into an estate plan.